Guide to Financial Disclosure in Massachusetts Divorce Cases

Divorce and Separate Support Actions Require Immediate Disclosures

In all Massachusetts divorce actions, a certain level of financial disclosure is required. In all cases, each party must complete a Financial Statement which provides a snapshot of current assets, debts, income and expenses. In most cases, parties must also provide three years’ of bank and other financial account statements, tax returns, pay stubs, and so forth.

Financial Statements

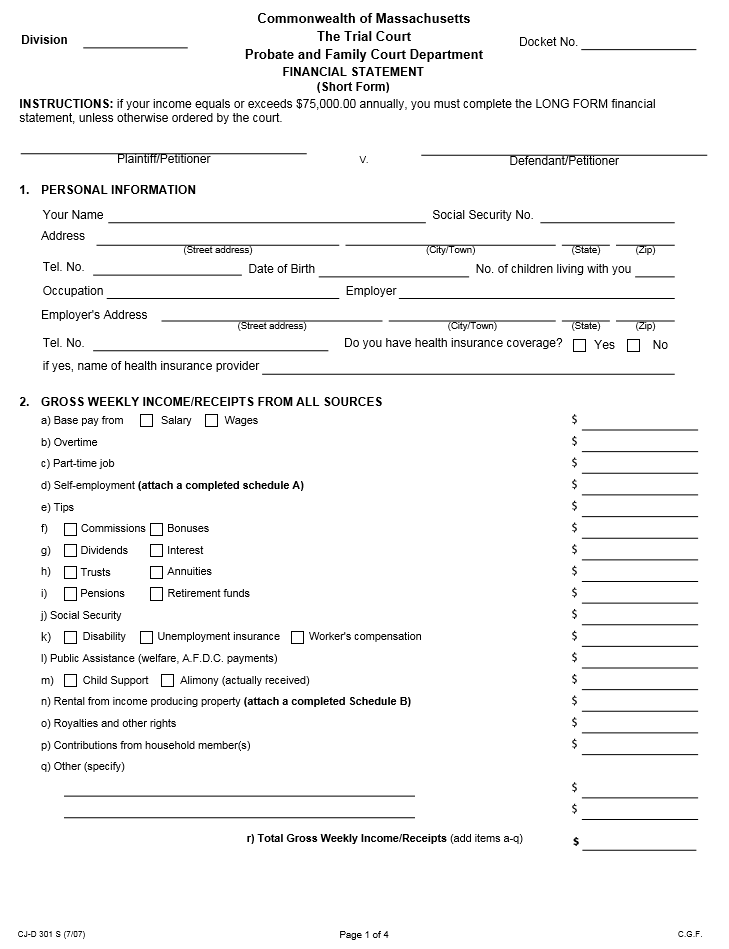

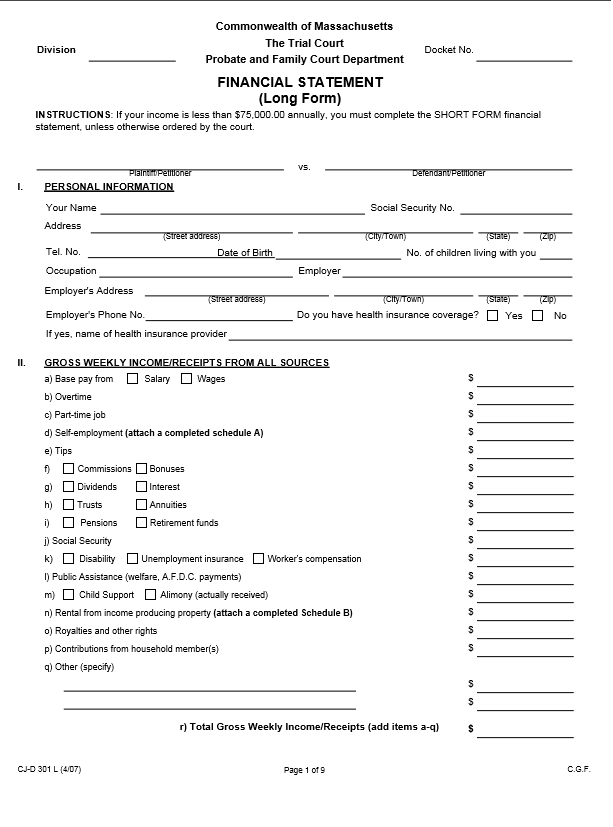

Financial Statements are required in all divorce cases in Massachusetts, even uncontested cases. There are two type of Financial Statements, a short form and a long form. The Short Form Financial Statement in Massachusetts consists of four pages and should be filed on pink paper. The Long Form Financial Statement in Massachusetts consists of nine pages and should be filed on purple paper.

How to complete the Short Form Financial Statement in Massachusetts

Here is a link to the Court’s website to download the Short Form Financial Statement: CLICK HERE

Here is a link to the Court’s website to download the Short Form Financial Statement: CLICK HERE

The short form consists of four pages, excluding attachments. The form should be filed on pink paper. This form is used by any family law litigant that earns less than $75,000 per year in gross income. The entire form must be completed for each hearing that you attend.

Section one: personal information

The first section of the short form Financial Statement requires you to fill out your personal information. Keep in mind that financial statements are “impounded” in the court’s file, which means that the general public is not supposed to have access to the documents. You will have to serve your financial statement on the opposing side.

Section two: gross weekly receipts

This section is one of the most important sections of the Short Form. You should make sure to disclose all forms of income that you receive from any source. Calculate the amounts you receive so that you include the weekly total. (Check out the helpful hint below for how to calculate weekly income).

Section three: itemized deductions

If you are an hourly or salaried employee, you have taxes, FICA, and other deductions that will show on your pay stub. These deductions need to be figured out and included.

HELPFUL TIP: If you are paid every two weeks, there are 26 pay periods each year. Multiply the amounts on your pay stub by 26, and then divide by 52 to get the weekly amount.

Section four: adjusted net weekly income

This section simply requires you to subtract your itemized deductions (section three) from your gross weekly receipts (section two).

Section five: other deductions

Section 5 allows you to include deductions that are automatically taken out of your pay for things like mandatory retirement, child support, 401k contributions, savings, etc.

Section six: net weekly income

Subtract section five from section four.

Section seven: gross year income from prior year

Find your W2, 1099s, and other documents that show your previous year’s income. Attach those to your Financial Statement and total them to state your total income for the previous year. Be careful that this is figure accurately represents your true income.

Section eight: Weekly expenses

Try to estimate your actual weekly expenses here. You may need to review your bills, credit card statements, and other expenses to figure this out. It generally does not help any family law litigant to under-estimate their expenses. Using estimates is okay, so long as the estimate is reasonable. For example, if you spend $100 per week on food, don’t declare that you spend $500 per week on food just to make your expenses seem larger than they are. Sometimes, divorce attorneys scrutinize alleged expenses to cross-examine the person that filled out the form. If the evidence doesn’t match up with the alleged expenses, the person that filled out the form will not appear credible to the court.

Section nine: counsel fees

Provide an estimate for the total cost of your divorce and the amounts you have paid in retainers.

Sections ten and eleven: assets and liabilities

These sections require a detailed list of assets and debts. If the other side did not fully disclose all the assets and debts, including account numbers, demand that they do so. Take the time to ensure that you have everything listed. Careful consideration of the valuation of assets should be given before just writing down any number. Remember, you may find yourself answering questions about the value of assets, including bank and investment account balances, so you’ll want to make sure your statements under perjury are accurate.

Self-employment income and rental income disclosure on the Financial Statement

There are two schedules that are attached to the Financial Statement, if they apply to your case. One schedule is used is used to detail income and expenses for rental property owned, and the second schedule is used for self-employed persons to disclose their income from their business(es). Both schedules should be done carefully with the assistance of your attorney and bookkeeper or accountant, especially the disclosure for self-employment income.

How to complete the Long Form Financial Statement in Massachusetts

The long form is very similar to the short form, but as you might imagine it requires more detail. The form has more options for types of income, more options for deductions from income, more options for weekly expenses, and so forth. Many of the line items on the Long Form Financial Statement will not be applicable, so you will just input “0” in those spaces. Here is a link to the Court’s website to download the Long Form Financial Statement in Massachusetts: CLICK HERE

The long form is very similar to the short form, but as you might imagine it requires more detail. The form has more options for types of income, more options for deductions from income, more options for weekly expenses, and so forth. Many of the line items on the Long Form Financial Statement will not be applicable, so you will just input “0” in those spaces. Here is a link to the Court’s website to download the Long Form Financial Statement in Massachusetts: CLICK HERE

Demand for Financial Statement

A party may provide written notice to other side that they must file and serve his or her Financial Statement within 10 days of the request according to the Domestic Rules of Procedure.

Mandatory Financial Disclosures – Rule 410

In addition to the Financial Statement required in every divorce and separate support case, each party to these family law cases is required to provide disclosures after service of the summons. Supplement Rule 410 of the Probate and Family Court provides the requirements.

Specifically, each party must deliver to the other party within 45 days of the service of the summons the following documents:

- The last three years’ federal and state income tax returns for personal, partnerships, LLCs, corporations or other entities and

- Must include W-2’s, 1099’s, K-1’s, and so forth to support the tax returns;

- The past three years’ bank account statements;

- The last four most recent pay stubs;

- Health insurance coverage cost and all associated documents;

- The past three years’ investment, brokerage account, retirement account statements, etc.;

- Copies of loan or mortgage applications made within the past three years; and

- Copies of any financial statements.

Further, parties are required to supplement all their disclosures if any material changes occur during the pendency of the case. Also, neither party may file any discovery motions prior to making the initial disclosures.

If the other party does not provide their Rule 410 documents, you should write a letter demanding that they provide their documents. If they still fail to provide their mandatory financial disclosures, you can file a motion with the court seeking that the court “compel” (i.e. force) the other side to comply with the rules and provide their documents. In that case, the prevailing party of the motion is usually entitled to attorney fees.

When Rule 410 Financial Disclosures are not Required

In certain cases, Rule 410 disclosures are not required in divorce matters. While the majority of cases will require the parties to each provide his or her complete financial disclosure, the following circumstances may alleviate a party’s responsibility to provide those disclosures:

- In “1A” divorce cases, which are uncontested, the parties are generally not required to exchange their Rule 410 documents. They do have to exchange their respective Financial Statements, however.

- In cases where parties agree that neither will have to provide their Rule 410 documents, the parties are relieved of that obligation. Such an agreement, also called a stipulation, should be used with caution.

Our attorneys specialize in handling financial statements and disclosures in divorce, separate support and other relevant domestic family law cases. For a free, initial consultation feel free to call our offices today.

Our firm serves the Boston area as well as all courts in Bristol County, including the New Bedford, Fall River and Taunton courthouses. We also serve all courts in Plymouth County including the Family and Probate Courthouses in Plymouth and Brockton.